kansas auto sales tax calculator

Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year. Maximum Local Sales Tax.

1040 Tax Calculator Kansas State Bank

Tax credits itemized deductions and.

. Vehicle property tax is due annually. The total sales tax rate in any given location can be broken down into state county city and special district rates. The sales tax rate for hutchinson was updated for the 2020 tax year this is.

Burghart is a graduate of the University of Kansas. The sales tax in Sedgwick County is 75 percent. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

The county the vehicle is registered in. How kansas motor vehicle dealers should charge sales tax on vehicle sales. Kansas Income Tax Calculator 2021.

Kansas State Sales Tax. The December 2020 total local sales tax rate was also 6250. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

How to Calculate Kansas Sales Tax on a Car. Kansas State Sales Tax. Kansas has a 65 sales tax and Wyandotte County collects an.

Tax and Tags Calculator. The minimum is 65. The base state sales tax rate in Kansas is 65.

Kansas car tax is 273368 at 750 based on an amount of 36449 combined from the sale price of 39750 plus the doc fee of 399 minus the trade-in value of 2200 minus the. The average cumulative sales tax rate between all of them is 663. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

If you make 70000 a year living in the region of Kansas USA you will be taxed 12078. To calculate sales tax visit Kansas Department of Revenue Sales Tax Calculator. Youll get the real exchange rate with the low fee were known for.

Kansas Vehicle Property Tax Check - Estimates Only. You pay property tax when you initially title and register a vehicle and each year when you renew your vehicle tags and registration. The tax rates used in the Tax Calculator are based on the new 2017 Kansas income tax rates but in some instances approximations may be used.

Local tax rates in Kansas range from 0 to 41 making the sales tax range in Kansas 65 to 106. The current total local sales tax rate in Johnson County TX is 6250. He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the.

Average Local State Sales Tax. Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. Maximum Possible Sales Tax.

In addition to taxes car. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. Your average tax rate is 1198 and your marginal tax rate is.

For the property tax use our kansas vehicle property tax check. Use the Kansas Department of Revenue Vehicle Property Tax Calculator to estimate vehicle. As far as all cities towns and locations go the place.

The most populous location in Butler County Kansas is El Dorado. Maximum Local Sales Tax. There are also local taxes up to 1 which will vary depending on region.

Average Local State Sales Tax. Maximum Possible Sales Tax. Kansas has a 65 statewide sales tax rate but.

Find your Kansas combined.

Motor Vehicle Fees And Payment Options Johnson County Kansas

Kansas Auto Sales Cars For Sale Wichita Ks Cargurus

Sales Tax Calculator Credit Karma

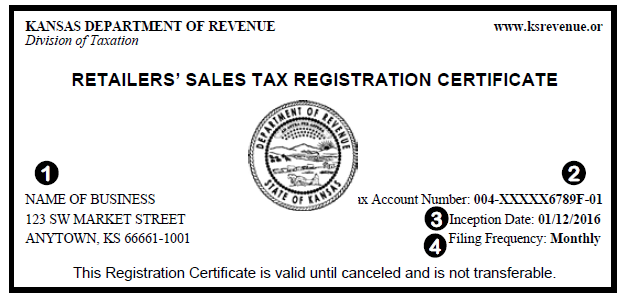

Kansas Department Of Revenue Pub Ks 1510 Sales Tax And Compensating Use Tax

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

A Complete Guide On Car Sales Tax By State Shift

How To Open A Car Dealership In Kansas 5 Simple Steps Surety Solutions A Gallagher Company

Used Car Dealer In Hiawatha Kansas Visit Hiawatha Ford Inc Today

Sales Taxes In The United States Wikiwand

Car Sales Tax In Kansas Getjerry Com

Car Sales Tax In Kansas Getjerry Com

States With The Highest And Lowest Sales Taxes

Used Vehicles For Sale In Topeka Ks Lewis Toyota Of Topeka

Finance For 300 And Under Zeck Ford

Dmv Fees By State Usa Manual Car Registration Calculator

Calculate Auto Registration Fees And Property Taxes Geary County Ks